MUMBAI | NEW DELHI: Stuck investments and low returns in India's realty sector are acting as deterrent for investments from ultra-high networth individuals (HNIs), who are now making a beeline for the country's startup space, where rapid growth promises to offset losses.

Take the case of Amit Maheshwari, for instance. Maheshwari, partner at audit firm Ashok Maheshwary & Associates, like many other investors had substantial exposure to real estate, but with price of his properties remaining stuck in low gear, he has now turned his attention to startups.

"Most HNIs have a skewed exposure to real estate, which is changing very fast due to lower returns in the sector and booming returns in the startup space. However, investments in the startups are also driven sometimes by the vanity attached to the angel investors these days, rather than just pure economics," said Maheshwari, who has invested in two startups in the last few months.

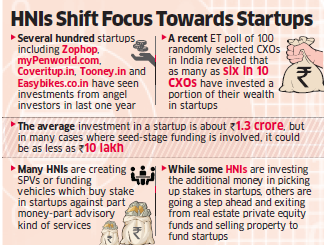

Several hundred startups including Zophop, myPenworld-.com, Coveritup.in, Tooney.in and Easybikes.co.in have seen investments from angel investors in the last one year.

A recent ETpoll of 100 randomly selected CXOs in India revealed that as many as six in 10 CXOs have invested a portion of their wealth in startups.

"Real estate was the favourite asset class for Indian HNIs. However, due to expected stagnant returns in real estate going forward, not only are HNIs avoiding investing more money into real estate, either directly or through funds, but are also exiting them wherever possible, and now are investing in the upcoming new asset class such as startups, where the amount invested could be as low as Rs 10 lakh and hence the risk can be spread across multiple startups," said Jeenendra Bhandari, partner at tax and audit firm MGB and Co LLP. Bhandari has himself invested in several startups. According to industry trackers, the average investment in a startup is about Rs 1.3 crore, but in many cases where seed-stage funding is involved, it could be as less as Rs 10 lakh. This is many because HNIs are also coming together for investment in startups. Many HNIs are creating SPVs or funding vehicles which buy stake in startups against part moneypart advisory kind of services. Both Maheshwari and Bhandari have invested in startups through investment vehicles.

Industry trackers said that while earlier an investment in a good residential project would double in three to four years, that hasn't been the case for the last few years. The days of 20% yearon-year returns, or in some cases abnormal returns for investors, are gone.

Sandeep Madan, a New Delhibased HNI who has been investing in property, said his investment in real estate has reduced but money will always seek better opportunities. He has put his bet on two startups in the ecommerce segment, but not the plain vanilla variety. "These are two businesses that are trying to take offline businesses online. For me, putting my money where I can add value is a better option," Madan said.

According to him, there are several large investors who are put ting money on multiple startups, but many of them are doing it blindly. "That probably happens because of lack of time," he said.

Even in the real estate market, Madan said, there are plenty of opportunities today for people who are ready to look for them. "You need to cherry pick, but the picking needs to be very careful with strong due diligence," he said. While investment in a startup may be a punt, for many it is not just about returns. Some angel investors are also attracted to the sector due to the vanity and the media attention an investment attracts, said an angel investor.

The philosophy of a typical angel investor is to invest small amounts in a large and diverse number of startups. Angel investing involves high risk and less returns, said industry trackers.

While some HNIs are investing the additional money in picking up stakes in startups, others are going a step ahead and exiting from real estate private equity funds and selling property to fund startups. These new-age HNIs are also investing in startups outside India.

Anckur Srivasttava, chairman of GenReal Property Advisers in Gurgaon, said he has looked at a few startup investing opportunities in recent months. His incremental investments in real estate, though, have reduced as his previous investments have become illiquid. "The churning of money has stopped," he said.

Srivasttava points out that returns in real estate haven't really come down but the timeline for these returns have stretched. Also, with many investors unable to exit their older investments because of the slow market, real estate as an asset class is not looking as great. "But smart investors are still investing in the asset class," he said.

A CEO of the real estate fund said he has invested in three startups so far, with an average investment of about Rs 25 lakh. "The amount I am investing in real estate has reduced because of my older investments being stuck and startup is emerging as a new opportunity," he said. "In a nutshell, today no one wants to invest in real estate and everyone wants to invest in startups. That was not the case three years back."

Comments:

Post Your Comment: