Summary of Findings

-

Two major federal government policies – the prohibition of foreign buyers and unprecedented immigration goals – will influence housing demand in BC for the next three years.

-

The demand effect of rising immigration is about five times greater than the Foreign Buyers Ban and is expected to significantly increase home prices.

-

To entirely counteract declining affordability, new home completions must rise 25% above their historical average and maintain this extraordinary construction rate for five years.

Introduction

In 2023, the Canadian federal government introduced two non-resident related policies that will significantly affect the BC housing market. The first policy, Bill C-19, or the Act Prohibiting the Purchase of Residential Property by Non-Canadians, enforces a two-year ban on home sales to non-Canadian buyers, commonly referred to as the Foreign Buyers Ban. The second policy involves raising Canada's immigration targets for the next three years, with plans to admit nearly 1.5 million new permanent residents to address critical labor market shortages. This surge in immigration will further strain an already supply-constrained housing market, resulting in increased competition for available homes and rising prices. Although the Foreign Buyers Ban will mitigate some of this demand, the number of foreign buyers deterred is considerably smaller than the housing demand generated by elevated immigration targets. New permanent residents, whom the government plans to admit by 2025, will be exempt from the Foreign Buyers Ban, as it does not apply to them. So, what will be the combined effect of these two policies on the BC housing market? In this Market Intelligence report, we aim to answer this question using our newly developed Real Estate Policy Analysis Model (REPAM).

Overview of New Federal Policies

Act Prohibiting the Purchase of Residential Property by Non-Canadians

The Act Prohibiting the Purchase of Residential Property by Non-Canadians, commonly known as the Foreign Buyer Ban, took effect on January 1, 2023. This legislation prevents non-citizens and non-permanent residents from buying residential real estate in Canada for a two-year period. However, exceptions exist for international students, temporary workers, refugees, spouses of Canadian residents, and others under specific conditions. Properties located outside Census Metropolitan Areas or Census Agglomerations, as defined by Statistics Canada, are not subject to the ban. Violators may face fines up to $10,000, and upon selling the property, they cannot receive more than the original purchase price. This penalty also applies to anyone who "counsels, induces, aids, or abets" a non-Canadian in acquiring residential property in Canada during this period.

The ban was implemented in response to a significant increase in residential home prices between spring 2020 and January 2022, with the belief that foreign buyers were contributing to this rise. Finance Minister Chrystia Freeland stated the goal was to prevent foreign investors from using Canadian homes as speculative financial assets and ensure they serve as homes for Canadian families. However, existing programs, like BC's Foreign Buyer Tax, indicate that only a small percentage (around 1%) of transactions involve purely foreign buyers. Consequently, there is limited evidence to suggest that the Foreign Buyers Ban will effectively lower home prices.

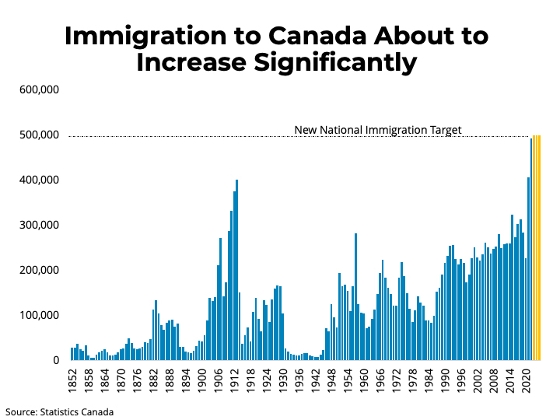

Increasing Immigration Targets

In November, the Canadian government unveiled plans to significantly boost the number of immigrants receiving permanent residency over the next three years. Following the admittance of over 406,000 new permanent residents in 2021 and 437,000 in 2022, the goal is to accept 500,000 new permanent residents by 2025. This represents a substantial increase from pre-pandemic levels, which saw around 341,000 new permanent residents in 2019. The driving force behind this increase is Canada's extremely tight labor market, characterized by an unemployment rate near its lowest level since the 1970s and approximately one million job vacancies as of Q3 2022.

As a result, the government intends to modify the composition of incoming immigrants, emphasizing the economic category over family reunification or refugee categories. The number of economic-class permanent residents, who typically possess sought-after skills, experience, and education, is planned to grow by 6.4% per year in 2025. Meanwhile, family reunification permanent residents will increase by 5.3% per year in 2025. In contrast, the number of refugees and humanitarian-class permanent residents will decrease by 6.5% per year. These new targets underscore Canada's aggressive policy of attracting and admitting economically advantageous immigrants. Statistics Canada reports that 23% of Canadians were born abroad, the highest proportion in the nation's history and the highest among G7 countries. The agency projects that this figure will increase to 34% by 2041.

Estimating the Impact on Housing Demand

To gauge the effect of these new policies on the BC housing market, we must first compare the proportions of sales to foreign buyers with purchases by new immigrant households.

Impact of Foreign Buyers Ban on Sales

Since 2016, the provincial government has gathered data on the extent of foreign purchases in BC through the Additional Property Transfer Tax, which is imposed on foreign investors. Consequently, reliable data exists on the number of transactions involving the types of buyers targeted by Bill C-19.

The proportion of non-resident buyers has consistently decreased since the implementation of the Foreign Buyer Tax. Additionally, since the start of the COVID-19 pandemic, the tax has been applied to an average of 0.4% of residential sales volume.

The exact number of units bought solely by foreign investors is not reported because the foreign buyer tax can be applied to a portion of the market value owned by a non-resident involved in a multi-party transaction. In our analysis, we assume that the missed unit sales to foreign investors would amount to 100 sales per month, or 2,400 sales throughout the two-year ban. This number is slightly lower than the volume of unit sales with some foreign involvement but considerably higher than what we roughly estimate as purchases by individual non-residents. Given the range of exemptions available to non-resident purchasers, this estimate is likely an overstatement.

Impact of New Immigration Targets on Sales

From a historical perspective, the increase in immigration planned for the next three years is striking. However, although these targets signify record levels of immigration to Canada, they are considerably lower as a percentage of the Canadian population compared to previous record immigration totals observed in the early 1900s.

To determine the market impact of increased immigration targets, we need to comprehend what the elevated national target entails for immigration to BC, the number of new households that will be formed, and the likelihood of new immigrant families to purchase residential property.

Historically, BC has received around 15% of total Canadian immigration, which amounts to an average of 39,000 new immigrants to BC each year. By applying that historical share to the new immigration target, BC will welcome 217,500 new permanent residents from 2023-2025, or 100,500 more new permanent residents than would be expected based on historical average immigration levels. A crucial question for analyzing housing demand, and a large unknown, is how many of these new residents are already in the country awaiting approval of their permanent resident status and how many are new arrivals. According to Immigration, Refugees and Citizenship Canada (IRCC), it is common for about 40% of new permanent residents to already be in Canada before receiving their Permanent Residence status.

These new permanent residents are already in the country and should not be considered as new housing demand. Thus, in our estimates, we assume that 60% of the estimated immigration inflows represent new arrivals to BC.

As some of the 217,500 new immigrants will be part of a family, estimating the impact on housing demand depends on approximating the number of new households that will be formed. Data from the 2021 Canadian Housing Survey reveals that the typical household size for immigrant families ranges from 2.5 to 3.4 members.

In our analysis, we use the mid-point of this range and assume a household size of three. With this assumption, the increase in immigration will result in approximately 20,500 new BC households beyond the average annual immigration.

This leads to a 20,500-unit increase in demand for either homeownership or rental housing solely from permanent residents. The demand from non-permanent residents, which is excluded from this analysis, could potentially be several times greater.

Considering the affordability challenges in many BC cities, only a portion of the new households formed as a result of increased immigration will become homeowners. For our analysis, we refer to the 2021 Canadian Housing Survey, which shows that recent immigrants to BC had approximately a 54 percent homeownership rate. By applying that share to our household estimate, we determine a static impact of new immigration targets of around 11,000 additional home sales, nearly five times the impact of the Foreign Buyers Ban.

The potential impact of increased immigration is significantly greater than the decline in sales due to the ban on foreign buyers. To understand how these overlapping policies will interact and influence sales and prices in the resale market, considering the market and economic factors prevailing during the analysis period, we turn to our policy analysis model, REPAM.

Model Analysis

The REPAM (Real Estate Policy Analysis Model) developed by BCREA is a small quarterly econometric model that allows BCREA to examine the impacts of hypothetical scenarios on the British Columbian real estate market. The model incorporates housing and macroeconomic data, including housing starts, completions, prices, price expectations, MLS® home sales, MLS® active listings, new MLS® listings, average household incomes, the average mortgage rate, and migration. Additionally, the model estimates other unobservable variables such as the number of potential buyers and the percentage of sales made by investors.

The interrelationships among these variables are estimated and integrated into a model that can evaluate how changes to different variables influence the housing market.

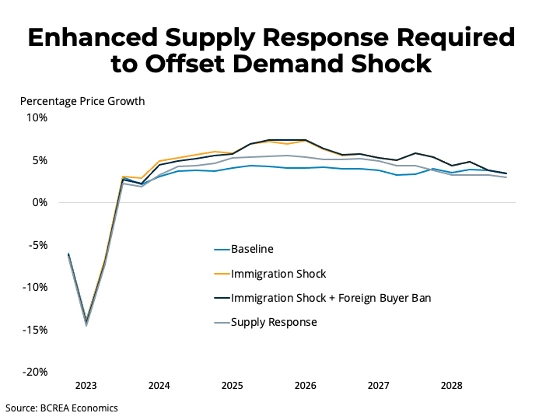

For instance, immigration shocks in REPAM are adjusted to align with census and housing survey data, as detailed earlier. Instead of providing a static estimate, we can simulate how the impact of the migration shock propagates over time and how it affects other aspects of the housing market. An immigration shock in REPAM results in a peak impact on sales after about three years. The effect of a stand-alone shock to immigration over the next five years is illustrated below. By simulating the impact on home sales and prices, we see an increase in home sales over a five-year period, which accelerates the recovery of home prices by more than 200 basis points above a baseline with no policy changes.

A key aspect of REPAM is that it incorporates two types of buyers - firstly, those searching for a primary residence, whose demand is driven by fundamental factors like migration, income growth, and affordability; and secondly, investors who are sensitive to interest rates but whose demand is also primarily driven by price expectations. This latter characteristic serves as a catalyst during tight market conditions and increasing prices, leading to a higher proportion of investor purchases.

-560-wide.jpg)

Consequently, REPAM forecasts that the immigration shock, which tightens market conditions and raises price expectations, also increases the share of both domestic and foreign investors. To incorporate the Foreign Buyers Ban in our analysis, we categorize foreign buyers as part of the investor segment in the model and reduce sales to investors by 300 sales per quarter. It is important to note that this assumes domestic investors do not compensate for the lost sales to non-resident investors.

Due to the Foreign Buyers Ban, there is a slight decrease in the total sales impact resulting from higher immigration and a minor alleviation of the subsequent upward pressure on home prices. However, price growth eventually catches up as the delayed effect of the immigration shock materializes after the two-year Foreign Buyers Ban period.

In order to mitigate the pressure on the housing market resulting from abrupt shifts in housing demand, governments can implement measures to boost housing supply. Such actions can encompass zoning amendments to permit more housing development, enhancing funding for affordable housing initiatives, and offering incentives to encourage developers to construct additional housing units.

Since REPAM incorporates a supply side that interconnects the new construction and resale markets, we can simulate an array of supply-side policy enhancements to evaluate the impact of these demand-side policies under an improved supply-side response. By doing so, we can better understand the potential effectiveness of different policy interventions in addressing the housing market challenges arising from increased immigration and the Foreign Buyers Ban.

-560-wide.jpg)

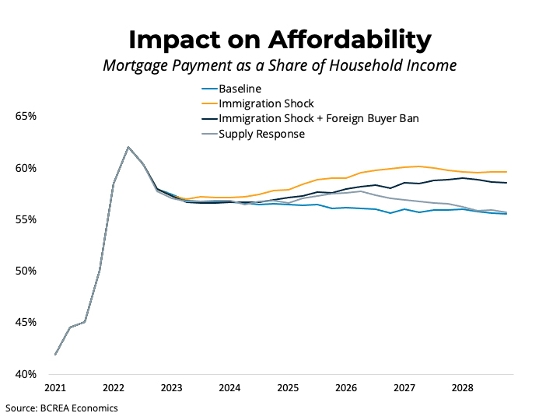

In a simulation that accounts for the impact of supply-side policy improvements leading to a sustained rise in housing completions, the increase in home prices caused by the demand shock is eventually counterbalanced as the ownership market is supplied with a higher volume of listings. This helps to keep price growth near its long-term baseline, and towards the end of the simulation horizon, price growth falls below the historical baseline as the demand shock diminishes and the flow of new housing remains strong.

In the model simulation, to completely offset the increase in immigration, new home construction in BC needs to increase by 25 per cent over the model baseline for the next five years, reaching a record level of about 43,000 completions per year. While this pace of completions is close to that achieved between 2020 and 2021, higher interest rates and weaker market conditions make this rate of completion less likely over our projection horizon.

Furthermore, an unintended consequence of the ban on foreign buyers is that financing new home construction becomes even more challenging without access to international capital markets. In fact, there have already been reports of up to 500 new rental units in Vancouver being canceled due to the ban. This highlights the complexity of the housing market and the need for a balanced approach when implementing policies to address both demand and supply factors.

Lowering price growth to allow income growth to catch up with housing prices is crucial for enhancing housing affordability in BC. In our simulations, an adequate supply response can not only counteract the effects on affordability caused by a demand shock but also contribute to a lasting improvement in affordability compared to the model baseline over an extended time horizon. This underscores the importance of implementing well-balanced policies that address both demand and supply factors in the housing market, ensuring long-term affordability and sustainable growth for the benefit of all residents.

Conclusion

In conclusion, while immigration is crucial for economic growth, job creation, and cultural diversity, it also significantly contributes to housing demand. As population growth and global migration patterns continue, it is vital to recognize and appreciate the positive impact of immigrants in the broader economy while addressing the resulting pressures on the housing market.

The challenge lies in creating policies and programs that support and welcome immigrants while addressing the consequences of increased housing demand on an already stressed market. Instead of limiting demand through taxation or prohibition, governments should focus on an abundance agenda for housing. This agenda should include more housing, fewer obstacles to building, and a streamlined process to bring housing to the market faster.

Without such an agenda, the market may face accelerated price growth and deteriorating affordability as demand soars and supply struggles to keep pace. A proactive approach to increasing housing supply while balancing the needs of a growing population can lead to a more stable and sustainable housing market in the long run.

Comments:

Post Your Comment: